Bookkeeping Projects

Diagnostic

$100

Diagnostic report for catchup/cleanup bookkeeping

Report delivered within 3 business days

Fee credited to accepted catchup/cleanup bookkeeping services

Catch-up Bookkeeping

Catchup bookkeeping up to 6 months

Tax returns current

Project completed within 45 days of receipt of all requested documentation

Cleanup Bookkeeping

6 to 24 months, not to exceed 2 calendar years of bookkeeping

Project completion based on cleanup period

Interval Bookkeeping

Import transactions

Categorize up to 300 transactions

Prepare adjusting entries

Reconcile all balance sheet accounts

Provide balance sheet, profit and loss, and cash flow statements within 15 days after all required documents are submitted.

Import transactions for the quarter

Categorize up to 900 transactions per quarter

Prepare quarterly adjusting entries

Reconcile all balance sheet accounts for the quarter

Provide balance sheet, profit and loss, and cash flow statements within 30 days after all required documents are submitted.

Bookkeeping Add-Ons

$3.75/statement

Automatically fetch your statements through Leger Docs to eliminate the tedious task of manually uploading bank statements.

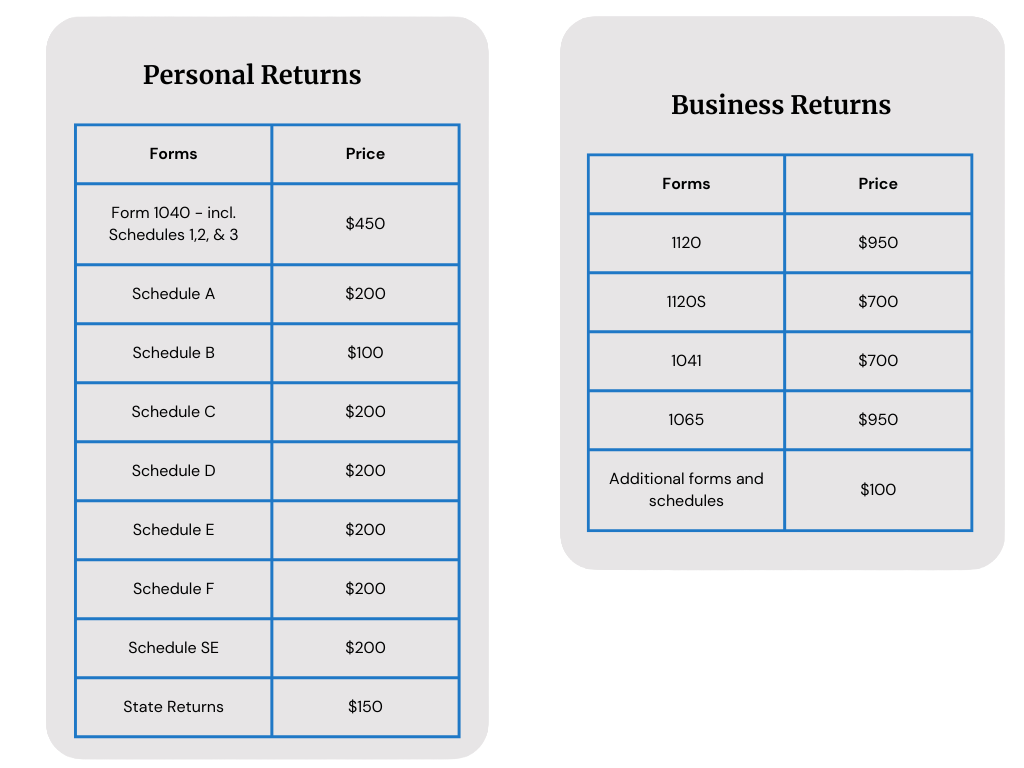

Tax Return Services

Comprehensive Tax Audit Defense™ coverage up to $1 million and Identity Theft Restoration services, provided through our exclusive partnership with Protection Plus

Guaranteed tax filing by April 15th, or we will file your Federal and state extensions at no additional cost ($150 value)

2024 IRS Income Verification Transcript included at no extra charge ($100 value)

Your $100 deposit will be applied as a credit toward your final invoice

Contact us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!